Box 8 And 9 Uk Vat Return . what are the changes to the vat return box labels? you do not have to include margin scheme purchases or sales in boxes 8 and 9 of your vat return. Here are the changes, listing the old vs the new label wording, and the notes provided by hmrc for each. Box 6 shows the total value of net sales for the period (excluding vat). include your box 8 figure: This is for the total sum of your net purchases and is for goods only that you sold to ec states. The total value of goods acquired from other eu countries. The hmrc making tax digital policy team have provided. You only need to fill in box 9 if the business has acquired goods from.

from www.youtube.com

Box 6 shows the total value of net sales for the period (excluding vat). you do not have to include margin scheme purchases or sales in boxes 8 and 9 of your vat return. This is for the total sum of your net purchases and is for goods only that you sold to ec states. The total value of goods acquired from other eu countries. You only need to fill in box 9 if the business has acquired goods from. Here are the changes, listing the old vs the new label wording, and the notes provided by hmrc for each. what are the changes to the vat return box labels? include your box 8 figure: The hmrc making tax digital policy team have provided.

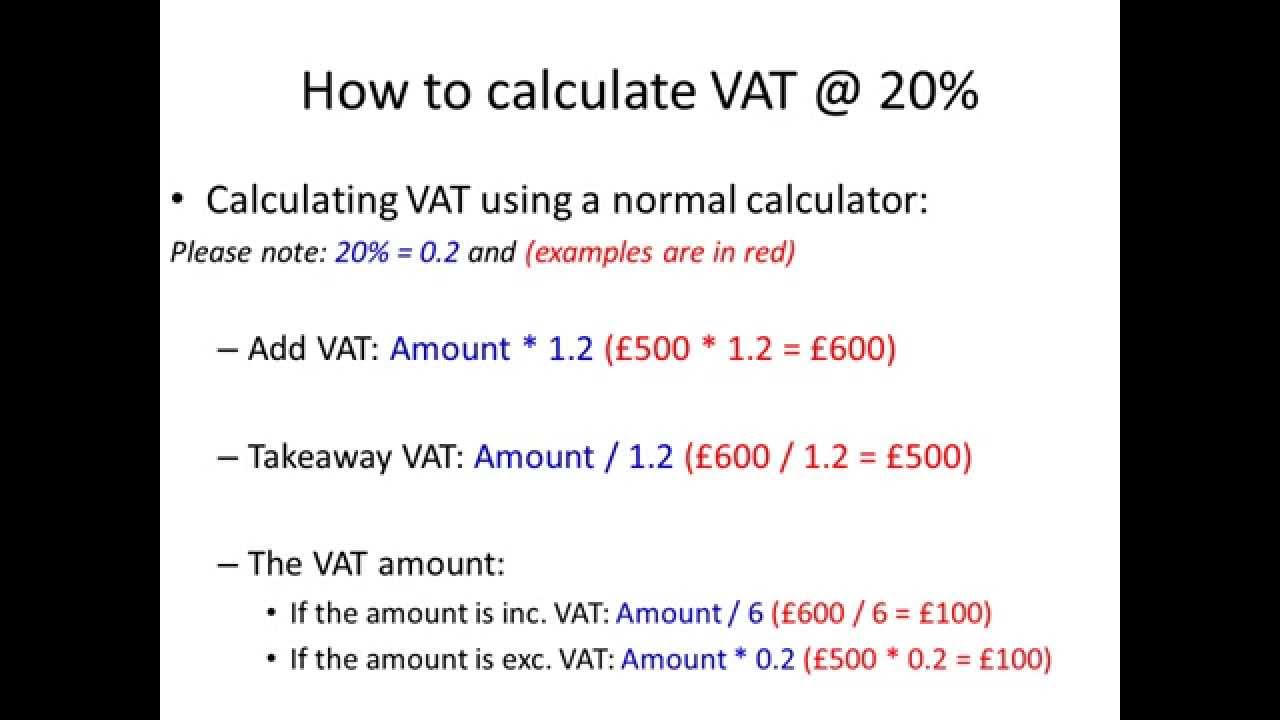

How to calculate VAT 20 (UK) from The VAT Calculator YouTube

Box 8 And 9 Uk Vat Return what are the changes to the vat return box labels? Here are the changes, listing the old vs the new label wording, and the notes provided by hmrc for each. include your box 8 figure: you do not have to include margin scheme purchases or sales in boxes 8 and 9 of your vat return. You only need to fill in box 9 if the business has acquired goods from. The total value of goods acquired from other eu countries. Box 6 shows the total value of net sales for the period (excluding vat). what are the changes to the vat return box labels? The hmrc making tax digital policy team have provided. This is for the total sum of your net purchases and is for goods only that you sold to ec states.

From community.quickfile.co.uk

VAT Adjustment Incorrect Figures Submitted to HMRC Vat return failed Box 8 And 9 Uk Vat Return Box 6 shows the total value of net sales for the period (excluding vat). you do not have to include margin scheme purchases or sales in boxes 8 and 9 of your vat return. This is for the total sum of your net purchases and is for goods only that you sold to ec states. The hmrc making tax. Box 8 And 9 Uk Vat Return.

From www.youtube.com

Input VAT vs Output VAT Explained YouTube Box 8 And 9 Uk Vat Return include your box 8 figure: The total value of goods acquired from other eu countries. You only need to fill in box 9 if the business has acquired goods from. Here are the changes, listing the old vs the new label wording, and the notes provided by hmrc for each. Box 6 shows the total value of net sales. Box 8 And 9 Uk Vat Return.

From www.signnow.com

Vat 652 to Print 20162024 Form Fill Out and Sign Printable PDF Box 8 And 9 Uk Vat Return The total value of goods acquired from other eu countries. Box 6 shows the total value of net sales for the period (excluding vat). include your box 8 figure: The hmrc making tax digital policy team have provided. you do not have to include margin scheme purchases or sales in boxes 8 and 9 of your vat return.. Box 8 And 9 Uk Vat Return.

From goselfemployed.co

How to Complete Your First VAT Return Box 8 And 9 Uk Vat Return include your box 8 figure: Box 6 shows the total value of net sales for the period (excluding vat). what are the changes to the vat return box labels? The hmrc making tax digital policy team have provided. The total value of goods acquired from other eu countries. This is for the total sum of your net purchases. Box 8 And 9 Uk Vat Return.

From sellercentral-europe.amazon.com

UK VAT return draft feedback Sell on Amazon Amazon Seller Forums Box 8 And 9 Uk Vat Return Box 6 shows the total value of net sales for the period (excluding vat). what are the changes to the vat return box labels? This is for the total sum of your net purchases and is for goods only that you sold to ec states. you do not have to include margin scheme purchases or sales in boxes. Box 8 And 9 Uk Vat Return.

From www.zoho.com

VAT in Sales Help Zoho Books Box 8 And 9 Uk Vat Return Box 6 shows the total value of net sales for the period (excluding vat). Here are the changes, listing the old vs the new label wording, and the notes provided by hmrc for each. you do not have to include margin scheme purchases or sales in boxes 8 and 9 of your vat return. The total value of goods. Box 8 And 9 Uk Vat Return.

From fill.io

Fill Free fillable HM Revenue & Customs PDF forms Box 8 And 9 Uk Vat Return You only need to fill in box 9 if the business has acquired goods from. The total value of goods acquired from other eu countries. Here are the changes, listing the old vs the new label wording, and the notes provided by hmrc for each. what are the changes to the vat return box labels? include your box. Box 8 And 9 Uk Vat Return.

From www.dreamstime.com

UK VAT Form stock image. Image of financial, fiscal, return 13421985 Box 8 And 9 Uk Vat Return Box 6 shows the total value of net sales for the period (excluding vat). you do not have to include margin scheme purchases or sales in boxes 8 and 9 of your vat return. The total value of goods acquired from other eu countries. what are the changes to the vat return box labels? You only need to. Box 8 And 9 Uk Vat Return.

From community.quickfile.co.uk

VAT Return Boxes 6 & 7 Accounting QuickFile Box 8 And 9 Uk Vat Return you do not have to include margin scheme purchases or sales in boxes 8 and 9 of your vat return. what are the changes to the vat return box labels? Box 6 shows the total value of net sales for the period (excluding vat). Here are the changes, listing the old vs the new label wording, and the. Box 8 And 9 Uk Vat Return.

From www.vatcalc.com

UK VAT return after Brexit Box 8 And 9 Uk Vat Return This is for the total sum of your net purchases and is for goods only that you sold to ec states. Box 6 shows the total value of net sales for the period (excluding vat). Here are the changes, listing the old vs the new label wording, and the notes provided by hmrc for each. include your box 8. Box 8 And 9 Uk Vat Return.

From www.sohu.com

一文了解英国税改新模式进口清关VAT递延_申报 Box 8 And 9 Uk Vat Return This is for the total sum of your net purchases and is for goods only that you sold to ec states. The total value of goods acquired from other eu countries. you do not have to include margin scheme purchases or sales in boxes 8 and 9 of your vat return. include your box 8 figure: Here are. Box 8 And 9 Uk Vat Return.

From www.pdffiller.com

Hmrc Vat Return Form Pdf Fill Online, Printable, Fillable, Blank Box 8 And 9 Uk Vat Return include your box 8 figure: You only need to fill in box 9 if the business has acquired goods from. you do not have to include margin scheme purchases or sales in boxes 8 and 9 of your vat return. The hmrc making tax digital policy team have provided. Box 6 shows the total value of net sales. Box 8 And 9 Uk Vat Return.

From ember.co

How much is VAT? A guide to UK VAT rates Box 8 And 9 Uk Vat Return This is for the total sum of your net purchases and is for goods only that you sold to ec states. what are the changes to the vat return box labels? you do not have to include margin scheme purchases or sales in boxes 8 and 9 of your vat return. The total value of goods acquired from. Box 8 And 9 Uk Vat Return.

From www.freeagentcentral.com

Checking, editing and locking a VAT return FreeAgent Support Box 8 And 9 Uk Vat Return include your box 8 figure: Here are the changes, listing the old vs the new label wording, and the notes provided by hmrc for each. The total value of goods acquired from other eu countries. The hmrc making tax digital policy team have provided. You only need to fill in box 9 if the business has acquired goods from.. Box 8 And 9 Uk Vat Return.

From www.shein.co.uk

DUBERY DUBERY Polarized Fashion Glasses For Men And Women 8 Colors Box 8 And 9 Uk Vat Return The hmrc making tax digital policy team have provided. you do not have to include margin scheme purchases or sales in boxes 8 and 9 of your vat return. Here are the changes, listing the old vs the new label wording, and the notes provided by hmrc for each. what are the changes to the vat return box. Box 8 And 9 Uk Vat Return.

From simpleinvoice17.net

Vat Invoice Example * Invoice Template Ideas Box 8 And 9 Uk Vat Return what are the changes to the vat return box labels? you do not have to include margin scheme purchases or sales in boxes 8 and 9 of your vat return. The total value of goods acquired from other eu countries. This is for the total sum of your net purchases and is for goods only that you sold. Box 8 And 9 Uk Vat Return.

From frisbi.zohodesk.com

UK VAT Registration FAQs Box 8 And 9 Uk Vat Return include your box 8 figure: You only need to fill in box 9 if the business has acquired goods from. The hmrc making tax digital policy team have provided. Here are the changes, listing the old vs the new label wording, and the notes provided by hmrc for each. you do not have to include margin scheme purchases. Box 8 And 9 Uk Vat Return.

From www.svtuition.org

Journal Entries of VAT Accounting Education Box 8 And 9 Uk Vat Return Here are the changes, listing the old vs the new label wording, and the notes provided by hmrc for each. This is for the total sum of your net purchases and is for goods only that you sold to ec states. what are the changes to the vat return box labels? Box 6 shows the total value of net. Box 8 And 9 Uk Vat Return.